Description

Trading Dominion – Portfolio Investing | 5,85 GB

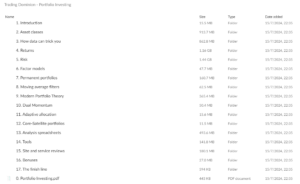

Trading Dominion – Portfolio Investing

In just a few hours, you can dive deep into the financial concepts that may have held you back from confidently managing your own investments. This course equips you with the knowledge and tools necessary to take control of your financial future. You’ll gain immediate access to a selection of pre-made portfolios, allowing you to start trading right away. Additionally, you’ll become part of a thriving private community comprised of hundreds of traders who support one another in their growth and development.

Course Overview

Introduction The course begins with a warm welcome, laying the groundwork for your learning journey. You will explore the distinction between strategic and tactical asset allocation, which is crucial for effective portfolio management. An introduction to bonds and various asset classes will follow, providing a well-rounded understanding of the investment landscape. You’ll also delve into hedge funds and learn how data can sometimes mislead you, emphasizing the importance of critical thinking in investment decisions.

Returns Understanding returns is fundamental to investing. This section covers the acquisition of historical data and the differences between linear and log scales. You’ll learn how to calculate arithmetic and log price returns, along with cumulative returns, which will empower you to assess past performance accurately. The course further explains the conversion between arithmetic and log returns and delves into the concepts of arithmetic and geometric means, alongside the wealth index and performance charts, equipping you with the skills to evaluate investment success.

Measuring Risk Risk is an inherent part of investing, and this module focuses on how to measure it effectively. You’ll study variance and standard deviation to understand portfolio volatility. The course covers key performance metrics such as the Sharpe ratio, Sortino ratio, Calmar ratio, and Martin ratio, allowing you to assess your portfolio’s risk-adjusted returns. You’ll also learn about Alpha and Beta to gauge your investments against market performance, along with correlation coefficients and R-squared values. Other essential concepts include the Treynor ratio, Information ratio, Value-at-Risk, and Expected Shortfall, all of which are critical for comprehensive risk management.

Factor Models This module introduces key financial models that help explain returns. You will study the Capital Asset Pricing Model (CAPM) and the Fama French three-factor model, both of which provide frameworks for understanding how various factors influence asset returns. These models are essential for making informed investment decisions based on empirical data.

Permanent Portfolios Here, you will explore different portfolio strategies, including Equal and Value-Weighted portfolios. You’ll learn how to calculate portfolio returns and review five distinct permanent portfolios. This knowledge will help you build and maintain portfolios that align with your long-term investment goals.

Moving Average Filters Moving average filters can enhance your trading strategies. This section covers single-asset moving average filters (M.A.F.) and their application across all assets in a portfolio, enabling you to refine your trading approach based on historical trends.

Modern Portfolio Theory (MPT) An introduction to Modern Portfolio Theory is crucial for understanding the relationship between risk and return. You will learn about correlation, the correlation matrix, and the efficient frontier, which illustrates the optimal portfolios available to investors. This section discusses minimum variance portfolios and mean-variance efficient portfolios, along with the importance of rebalancing. You’ll also explore the Capital Allocation Line and the effect of margin on returns, and discover the Kelly Criterion for determining the optimal bet size. The course wraps up this section by introducing inverse variance and risk parity portfolios, rounding out your knowledge of advanced portfolio management techniques.

Dual Momentum This module reviews six different dual momentum portfolios, providing insights into this popular investment strategy that combines trend-following and relative strength.

Other Portfolios Finally, you will review two Adaptive Allocation portfolios and two Core-Satellite portfolios. These strategies provide additional flexibility and can be tailored to various market conditions, further enhancing your investment toolkit.

By the end of this course, you will possess a comprehensive understanding of portfolio investing, armed with the skills to confidently manage your investments. Join us today to start your journey toward financial independence.

For more information and to enroll, visit the Trading Dominion Portfolio Investing homepage.