Description

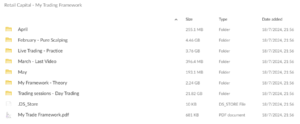

Retail Capital – My Trading Framework | 33.1 GB

Retail Capital – My Trading Framework: The Ultimate Day Trading Guide

In “Retail Capital – My Trading Framework,” a comprehensive guide based on over 13 years of trading experience, you’ll find a no-nonsense approach to day trading. This isn’t about selling a dream but about digging into the hard work that successful trading requires—both in terms of technical analysis and personal discipline. The guide provides a deep dive into the trading framework that has been honed over more than a decade, including live trading reviews (showcasing both winning and losing days), statistical analyses, and backtested strategies.

This trading guide is designed to be a realistic companion for traders who are ready to put in the time and effort needed to build their skills and consistently improve their results. Whether you’re a beginner looking to grasp fundamental concepts or an experienced trader seeking to refine your approach, this framework will provide practical insights that can be applied directly to your trading journey.

The Technical Topics Covered:

- Rotation: Rotation is a key concept that plays a pivotal role in understanding market movement. Traders must recognize when sectors or asset classes rotate, often shifting from one trending sector to another. This section covers how to track and analyze rotation effectively, helping you capitalize on shifts in momentum and market trends.

- ADR (Average Daily Range) Deep Dive: Understanding the Average Daily Range (ADR) is crucial for traders looking to time entries and exits. This section goes beyond just calculating ADR—it dives into how traders can use this information to forecast price action and volatility. By mastering the ADR, traders can better plan their trades around expected market movement, minimizing risks and enhancing profit potential.

- Backtesting of a Long-Only Strategy: This section delves into the long-only strategy—a popular approach that focuses solely on buying assets (rather than shorting them). The guide walks you through how to backtest this strategy using historical data to determine its effectiveness. Traders will learn how to use backtesting as a tool to improve their strategy and optimize decision-making before applying it to live markets.

- Footprint & Volume Profile: The footprint and volume profile provide invaluable insights into market activity by highlighting where significant buying and selling are occurring. Understanding the footprint gives traders a granular view of the order flow and market behavior, allowing them to make more informed trading decisions. This part of the guide covers how to use these tools to spot potential reversals, breakouts, or areas of consolidation.

- Stats on the VIX (Volatility Index): Volatility plays a critical role in trading, and the VIX is the premier tool for measuring market volatility. This section covers the importance of tracking the VIX and using it as a barometer for market sentiment. By analyzing VIX stats, traders can gauge when the market might experience significant moves and adjust their strategies accordingly.

Live Trading Reviews – Winning and Losing Days:

No trader wins every trade, and the guide emphasizes this reality by sharing live trading examples from both winning and losing days. The goal is to help traders learn not just from the wins but from the losses, understanding that setbacks are a natural part of the process. Each live trade review is dissected to explain the reasoning behind the trade, the entry and exit points, and what lessons were learned—whether the trade was a success or a failure. These real-world examples are essential for any trader looking to refine their approach and minimize emotional responses to losses.

Backtesting, Stats, and Strategy:

Backtesting is a key component of successful trading, and this guide shows you exactly how to use it to your advantage. The author walks through the backtesting process for various strategies, emphasizing the long-only approach, and shows how to analyze historical data to determine whether a strategy is worth pursuing. The goal here is to equip traders with the tools they need to fine-tune their strategies based on hard data, not just intuition or gut feeling.

Additionally, the guide discusses how to leverage statistical analyses to gain a better understanding of market conditions. By tracking and reviewing market statistics—such as the VIX, ADR, and more—traders can better forecast market behavior and make more informed decisions about when and how to trade.

Bonus Insights:

While the guide covers a wide range of technical topics, there’s also a bonus section that provides extra insights and tips for traders at all levels. This section touches on various aspects of trading psychology, market sentiment, and some lesser-known techniques that the author has found valuable throughout his trading career. Though this section may seem like a collection of miscellaneous tips, it’s full of practical advice that can be integrated into your trading approach.

Realistic Expectations:

What sets this guide apart from many others is the honest, no-hype approach. The author stresses that trading is not a get-rich-quick scheme. It requires dedication, discipline, and a lot of learning. There’s no shortcut to success in trading, and this guide makes that clear from the beginning. It’s about putting in the work—both on yourself and on understanding the markets.

The guide also encourages traders to take a holistic approach to their trading business. This includes tracking trades meticulously, analyzing both wins and losses, and consistently reviewing strategies to see where improvements can be made. Whether it’s by refining entry points, adjusting position sizing, or improving risk management, there’s always something that can be done to enhance your trading outcomes.

Conclusion:

“Retail Capital – My Trading Framework” provides a comprehensive, grounded approach to day trading, especially for those focused on the foreign exchange and equity markets. Through technical analysis, backtesting, and a focus on market fundamentals, this guide lays out a structured pathway to success. The lessons shared are based on real-world trading experience, making this guide an invaluable resource for anyone serious about mastering the art of day trading.

For those ready to invest time into their personal development and trading skills, this guide offers a treasure trove of insights, strategies, and practical tips that will undoubtedly accelerate your journey toward becoming a successful trader.