Description

InvestiShare – Trend Hunter Strategy | 967 MB

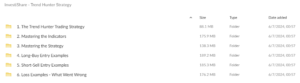

InvestiShare – Trend Hunter Strategy: A Momentum Trading System for Profitable Results

InvestiShare’s Trend Hunter Strategy is a powerful trading system designed to capitalize on market momentum, offering traders a highly effective approach to navigating both bull and bear markets. With a 65% win rate, this strategy is recognized for its profitability and adaptability, making it suitable for a variety of market conditions. Whether you’re trading in spot markets or futures, the Trend Hunter Strategy promises faster, safer profits, particularly when the market is in motion rather than in consolidation.

What is the Trend Hunter Strategy?

At its core, the Trend Hunter Strategy is a momentum-based system. This means that it focuses on identifying and riding market trends, whether upward or downward, to generate returns. Unlike some strategies that struggle during volatile periods or in bear markets, the Trend Hunter Strategy thrives in these environments by:

- Spotting trends early and entering trades as momentum builds.

- Capitalizing on shifts in market sentiment, whether it’s a bullish rally or a bearish downturn.

- Avoiding consolidation zones, where price movement tends to be stagnant and risky for most momentum strategies.

This strategic emphasis on market momentum gives traders a clear advantage, especially in futures markets, where leveraging opportunities can significantly amplify profits.

Spot vs. Futures Trading: Which is Better for Trend Hunter?

While the Trend Hunter Strategy can be applied to both Spot Trading and Futures Trading, it’s particularly effective in the futures market. Here’s why:

- Futures Trading offers leverage: With futures, traders can control a larger position with less capital, allowing for higher potential profits when the market moves in the desired direction.

- More opportunities in futures: Due to the high liquidity and extended trading hours in futures markets, traders have more opportunities to apply the Trend Hunter Strategy to catch significant moves.

- Flexibility in both markets: The strategy can still be profitable in the spot market, especially for traders looking to avoid the higher risk that comes with leveraged futures trading.

For those comfortable with futures, the Trend Hunter Strategy offers a highly efficient way to maximize the potential of market trends while maintaining a disciplined approach to risk management.

Why Choose the Trend Hunter Strategy?

The Trend Hunter Strategy is ideal for traders looking for a reliable, momentum-based system with proven results. Here’s what sets it apart:

- Momentum Trading for All Markets: Whether the market is rising or falling, the Trend Hunter Strategy can identify profitable entry points. This makes it versatile and adaptable for traders looking to profit in a variety of market conditions.

- Avoids Consolidation Risks: One of the biggest challenges in trading is getting stuck in periods of market consolidation, where prices move sideways and gains are minimal. The Trend Hunter Strategy excels at identifying trending markets and steering clear of risky consolidation zones.

- Increased Profitability in Futures: While it works in both spot and futures markets, the strategy’s potential for higher returns is amplified in the futures market. Leverage allows traders to capitalize on large price swings, making the Trend Hunter Strategy particularly attractive for futures traders.

- High Win Rate: With a 65% win rate, this strategy has proven to be highly effective. Traders can rely on consistent results while minimizing losses through disciplined trade management.

Who Should Use the Trend Hunter Strategy?

The Trend Hunter Strategy is suitable for:

- Momentum traders who are comfortable with entering trades during significant market moves and are looking to capitalize on trends.

- Futures traders seeking a strategy that can maximize the benefits of leverage while managing risk effectively.

- Spot traders who want a system that helps them avoid the pitfalls of consolidation and focus on clearer trends.

- Both novice and experienced traders: Whether you’re new to trading or have years of experience, the Trend Hunter Strategy’s straightforward approach to identifying momentum makes it accessible to a wide range of skill levels.

Conclusion

The Trend Hunter Strategy by InvestiShare is a robust, momentum-driven approach for traders looking to make consistent profits in both bullish and bearish markets. Its ability to steer clear of consolidation and focus on trend-based opportunities makes it ideal for futures traders, though it also offers value in spot markets. With a 65% win rate, traders can rely on its proven success while taking advantage of its flexibility across various market conditions.

To learn more or to get started with the Trend Hunter Strategy, visit InvestiShare Trend Hunter.